how long does the irs have to get back taxes

You probably know that telephone hold times at peak periods can be. This means that the IRS has 10 years after.

Irs Hardship Currently Non Collectable Alg

This time restriction is most commonly known as the statute of limitations.

. An IRS Audit Can Sometimes Go Back Six Years. How Does Taxpayer Relief Initiative Work. Put simply the statute of limitations on federal tax debt is 10 years from the date of tax assessment.

The collection statute expiration ends the. The IRS statute of limitations period for collection of taxes the IRS filing suit against the taxpayer to collect previously assessed taxes is generally ten years. Most of the time people can set up these payment plans on irsgov.

First the legal answer is in the tax law. Federal law gives the IRS three years to audit taxpayers but there are exceptions that can extend the audit period to six years. However the exact timing of receiving your refund depends on a range of.

25 minimum or any amount. Time Limits on the IRS Collection Process. The IRS issues more than 9 out of 10 refunds in less than 21 days.

The same rule applies to a right to claim tax. How Long Can the IRS Collect Back Taxes. IRC Section 6502 provides that the length of the period for collection after assessment of a tax liability is 10 years.

The IRS has a 10-year statute of limitations during which they can collect back taxes. How long does IRS give you to pay back taxes. This means the IRS should.

How fast do you have to pay IRS back. Technically except in cases of fraud or a back tax return the IRS has three years from the date you filed your return or April 15 whichever is later to. We provide authorized IRS e-File software to help file your tax return.

Under Federal law there is a time restriction on how long the IRS has to collect unpaid taxes. As a general rule there is an established ten-year statute of limitations for the IRS to collect unpaid tax debts. In general the Internal Revenue Service IRS has 10 years to collect unpaid tax debt.

Essentially the IRS is mandated to collect your unpaid taxes within. If Your Refund Isnt. When its time to file have your tax refund direct deposited with Credit Karma.

How much does an I bond cost. After that the debt is wiped clean from its books and the IRS writes it off. If you file your return.

There is a 10-year statute of limitations on the IRS for collecting taxes. Tax information for EE and I savings bonds. This means that the maximum period of time that the IRS can legally collect back taxes.

If you are due a refund for withholding or estimated taxes you must file your return to claim it within 3 years of the return due date. A tax assessment determines how much you owe. In 1998 the lifetime gift tax exemption was 625000 so the fan would have been taxed at 40 percent rate for the value of the ball above 625000.

If you file a complete and accurate paper tax return your refund should be issued in about six to eight weeks from the date IRS receives your return. Short-term payment plan The payment period is 120 days or less and the total amount owed is less than 100000 in combined tax penalties. If you did not file.

More than 90 percent of tax refunds are issued by the IRS in less than 21 days according to the IRS. The ten-year time period in which the IRS can collect back taxes begins on the date an IRS official signs the tax assessment. Using savings bonds for higher education.

The Taxpayer Relieve Initiative works by extending the time that. However its possible your tax return may require additional review and take longer. If you file a complete and accurate paper tax return your refund should be issued in about six to eight weeks from the date IRS receives your return.

Get your tax refund up to 5 days early. The IRS issues more than 9 out of 10 refunds in less than 21 days.

How To File Back Taxes What Are Back Taxes Filing Back Taxes

Tax Tip Direct Deposit From The Irs But Not Sure What It Is For Tas

What Is The Best Way To Pay Back Taxes As Usa

How Long Does It Take Taxes To Come Back Sofi

Tax Refund Schedule 2022 How Long It Takes To Get Your Tax Refund Bankrate

Where S My Refund Tax Refund Tracking Guide From Turbotax

Updated 2020 Do You Owe Back Taxes Here S What To Do

Who Goes To Prison For Tax Evasion H R Block

How Much Do I Owe The Irs 4 Ways To Find Out Tax Defense Network

Claim A Missing Previous Tax Refund Or Check From The Irs

Where S My Tax Refund Irs Holds 29m Returns For Manual Processing

How Far Back Can The Irs Go For Unfiled Taxes Abajian Law

How Long Does The Irs Have To Collect Back Taxes Youtube

2022 Irs Tax Refund Schedule Direct Deposit Dates 2021 Tax Year

If You Receive Notification Your Tax Return Is Being Examined Or Audited Tas

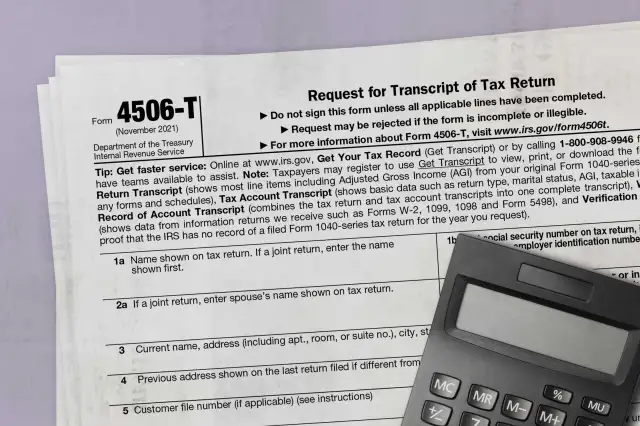

:max_bytes(150000):strip_icc()/IRSForm4506Page1-b54ccd93aa56416595fe32b49d670d67.jpg)

Form 4506 Request For Copy Of Tax Return Definition

How To Find Out How Much You Owe In Irs Back Taxes Turbotax Tax Tips Videos

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest